General Regulation

Public Works and Related Services Law

The Public Works and Related Services Law (LOPSRM) establishes the legal framework governing the contracting, execution, maintenance, and oversight of public works carried out by federal government agencies and entities in Mexico. Its primary objective is to ensure that public works processes are conducted under the principles of efficiency, transparency, legality, and competition, promoting the proper use of public resources. The law also covers services directly related to public works, such as studies, project design, supervision, and maintenance, and defines the procedures for bidding, awarding, and executing contracts to ensure the orderly and responsible development of public infrastructure.

Public-Private Partnerships Law

PPP are projects carried out under any model that establishes a contractual long term relationship between the public and the private sectors (concessions, leases, service delivery projects, financed public works), for public service delivery, where part or all the infrastructure required is provided by the private sector. PPP objective is to encourage private investment in infrastructure to increase the efficiency in the delivery of public services.

The PPP law regulates the different schemes used for the development of projects under the Public Private Partnership mechanism, and was enacted in January 2012 to provide a unique regulation for the development of these projects, while ensuring transparency and accountability in the use of public resources.

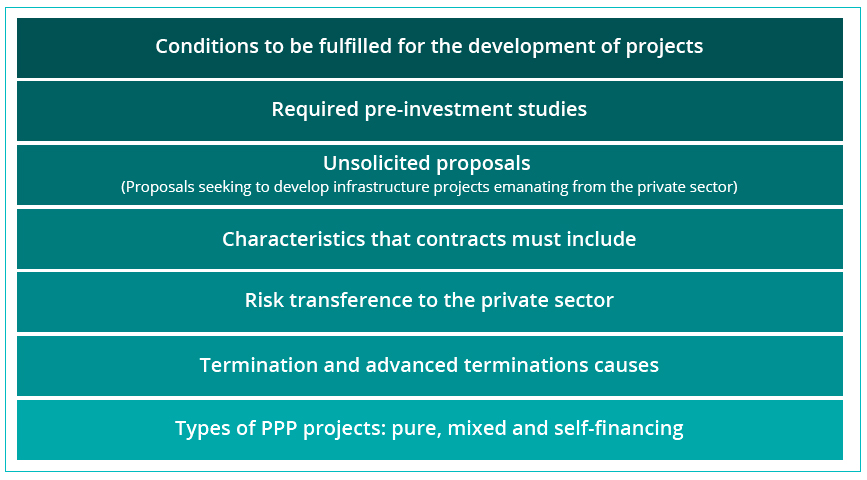

This law regulates:

In Mexico there are different schemes to carry out public-private participation projects, among which are included:

Concessions: The private sector builds and operates the project. Generally, the investment is recovered through the fees paid by the users of the project. The scheme is mainly used for roads, ports and airports.

Financed public works: The private developer carries out all the investments required by the project; at the end of the work, the public entity settles the total contracted investments. Generally used in the electricity sector.

Joint ventures: Particular risk sharing schemes, mainly for the hydrocarbon sector.

Public-private partnerships: The private developer provides part or all of the infrastructure for the provision of public services over a long-term horizon. The public sector pays a consideration to the private sector for such services. This scheme is mainly used for hospital projects, road maintenance, penitentiary centers and hydraulic infrastructure.

PPPs can be carried out by:

Entities of the Federal Public Administration

Federal Public Trusts not considered as state-owned entities

Federal entities with constitutional autonomy

Federal entities (states), municipalities and other public entities with federal resources

PPP are not subject to the regulations of the procurement laws (Ley de Adquisiciones, Arrendamientos y Servicios del Sector Público / Ley de Obras Públicas y Servicios Relacionados con las Mismas). These projects must have technical, economic, legal, social, and environmental impact feasibility studies, as well as a value for money analysis that concludes the convenience of developing the project as a PPP. It is important to mention that the observance of the PPP law is optional, since other sectorial federal laws may apply.

The PPP Law and its regulations are available at the following link:

PPP Legal framework

Regulation of the PPP Law

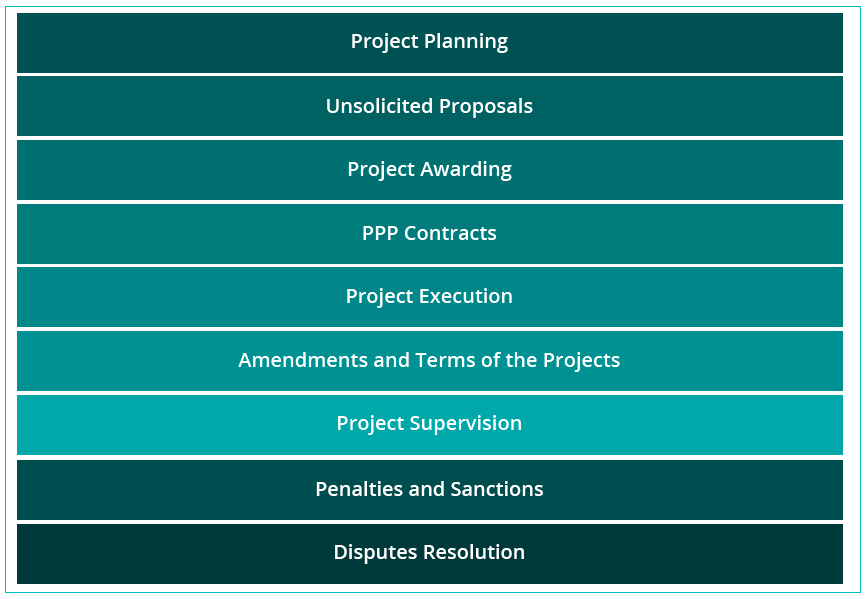

The PPP Law has a complementary regulation that, among other guidelines, include the following:

Project Planning

The allocation of federal funds to projects requires the previous authorization of the Chamber of Deputies, according to the following steps:

- Viability assessment: must be prepared by the sponsor entity.

- Registration in the Investment Portfolio of the Ministry of Finance, based on social profitability and the public private comparator.

- Authorization of the Inter-ministerial Commission for Public Expenditure, Financing and Disincorporation. The commission prioritizes the execution of the projects.

- Inclusion of the project in the Expenditure Budget Project: the Ministry of Finance includes the projects to be finance with federal funds in the Federal Expenditure Budget for the approval of the Chamber of Deputies.

- Approval by the Chamber of Deputies

Unsolicited Proposals

Any eligible person, interested in developing a PPP project, can submit its proposal to the responsible authority:

- The authority can determine the type of projects eligible for unsolicited proposals, including sectors, subsectors, and geographical location.

- The delivery of the proposal only grants right for its evaluation.

- The authority decides if it is appropriate to carry out a tender and reimburse to the offeror the cost of the pre-investment studies.

- If applicable, the reimbursement cannot exceed 4% of the initial investment of the project, whether the offeror participates or not in the tender process.

- The reimbursement certificate will be null if the request for proposals cannot be launched due to causes attributable to the offeror, or if once launched the tender, the project is not awarded and the authority decides not to purchase the pre-investment studies.

Authorizations and Contract

The PPP law encourages flexible contractual mechanisms that are transparent in terms of risk sharing, and rights and obligations of the parties:

- Procurement procedures are applicable: public, closed or negotiated tender.

- Assets and rights required for the execution of the projects can be obtained by the sponsor, the developer or both.

- Relevant characteristics of the PPP contracts are:

- Changes to agreed compensations are considered.

- Additional / complementary revenue determination and its allocation.

- Outsourcing services.

- Transfer of rights and applicable complementary activities.

- Final asset delivery once the contract ends.

- PPP are formalized through a delivery service contract and, where appropriate, and agreement of work execution, as well as any concessions, permits, and necessary licenses.

- The sponsor may take control of the project if the developer fails to comply with his obligations, endangering its development.

- Modifications to the contract are allowed, provided that no transference of risks take place.

- PPP contracts can be terminated in advance.

- Parties will settle the guidelines, terms and conditions for partial assessments of the project execution (in case of disputes, an experts committee and arbitration proceedings).

If the project requires federal funds, the economic and financial viability analysis must include a feasibility section considering:

- Convenience of the Project

- Effects in the balance of the sponsor, with original considerations and alternative scenarios

- Reasonable Assumptions of Required Budgetary Allocations and Expenses

- Risk Distribution

- Other PPP Projects that involve the sponsor

Applicable guidelines for Public-Private Partnerships

The Investment Unit of the Ministry of Finance has issued guidelines applicable to PPP in terms of registry, social assessment, and convenience.

All PPP projects that require federal funds must have a registration code in the Investment Portfolio of the Ministry of Finance. To receive this code, the sponsor must follow the guidelines mentioned above.

- Social Profitability Assessment – Demonstrate that the projects will generate benefits to society, considering direct and indirect costs and benefits..

- Relevance in the starting term – Determine the ideal moment for PPP Project to be operational; in some cases better to postpone its execution.

- Sensitivity Analysis – Identify the effects caused by a modification in the most important variables of the project.

- Risks Analysis – Idetnify risks associated to the project; classify the ricks depending on the probability of ocurrence, analyze the impact on the development of the project, and mitigation measures.

- Eligibility Index – For each project, the sponsor must create a working group, formed by at least seven public officers with a minimum hierarchy of director, in order to make decisions that affect the development or execution of the PPP project.

To estimate VFM, a public private comparator must be prepared, determining if the PPP creates equal or higher benefits than those that would be obtained if the project was developed in its entirety by the public sector. This model will consider the reasonable expected efficiencies, based on all risks and their distribution.

It is recommended to consult information relevant with the applicable guidelines for Public-Private Partnerships described below in their respective websites:

GUIDELINES that establish the dispositions to determine the convenience of carrying out a project through a Public-Private Partnership scheme

GUIDELINES for the para la elaboration and presentation of the cost-benefit analysis of the programs and investment projects.

GUIDELINES for the registration in the Programs and Investment Projects Portfolio.

GUIDELINES for the determination of the information requirements that the programs and investment projects planning mechanism must contain.

GUIDELINES for monitoring the excercise of the programs and investment projects, long-term productive infrastructure projects, and Public-Private Partnership projects of the Federal Public Administration.

For projects to which the PPP Law does not apply, each infrastructure sector is governed by specific regulations, which can be found in the following links:

SICT

Legal systems

SENER / CFE

Legal systems

PEMEX

Legal systems

SEP

Legal systems

SALUD

Legal systems

SECTUR

Legal systems

ISSSTE

Legal systems

IMSS

Legal systems

ECONOMÍA

Legal systems

SEMARNAT / CONAGUA

SEGOB

Legal systems